Why Real Estate Matters

For most individual investors and families, their ancestral home or primary residence (if they own it) remains the single largest asset on their personal balance sheets. Indeed, real estate is the largest and the most important asset class worldwide, among individuals as well as institutional investors. As per Savills World Research, value of global real estate assets was valued at USD 280 trillion at the end of 2017. In other words, global real estate was worth more than global equities and debt securities combined, and over three times the world’s GDP.

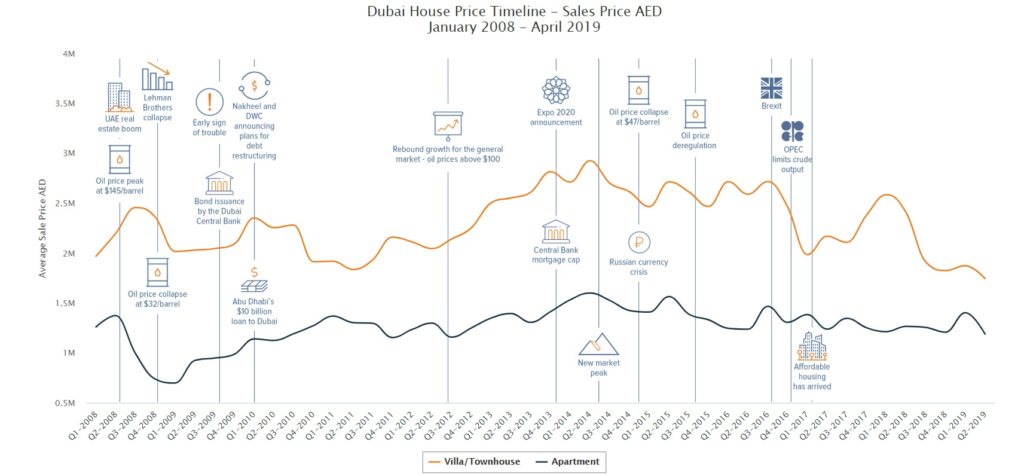

Despite the illiquidity inherent in conventional real estate assets (especially in developing markets), investors are drawn to real estate investments for steady yields and/or capital appreciation. Also, real estate as part of a multi-asset class portfolio offers diversification benefits to investors, due to its low correlation to equities. However, real estate investments have been vulnerable to economic cycles, and the illiquidity tends to magnify losses for investors looking to exit during a downturn. A prime example of this is Dubai (as illustrated in the chart below), which has been one of the most volatile real estate markets in the last decade. Markets in a number of other emerging economies have witnessed moderate to sharp declines in the last few years, including Brazil, India, UAE, Turkey and Egypt.

Source: Propertymonitor.ae

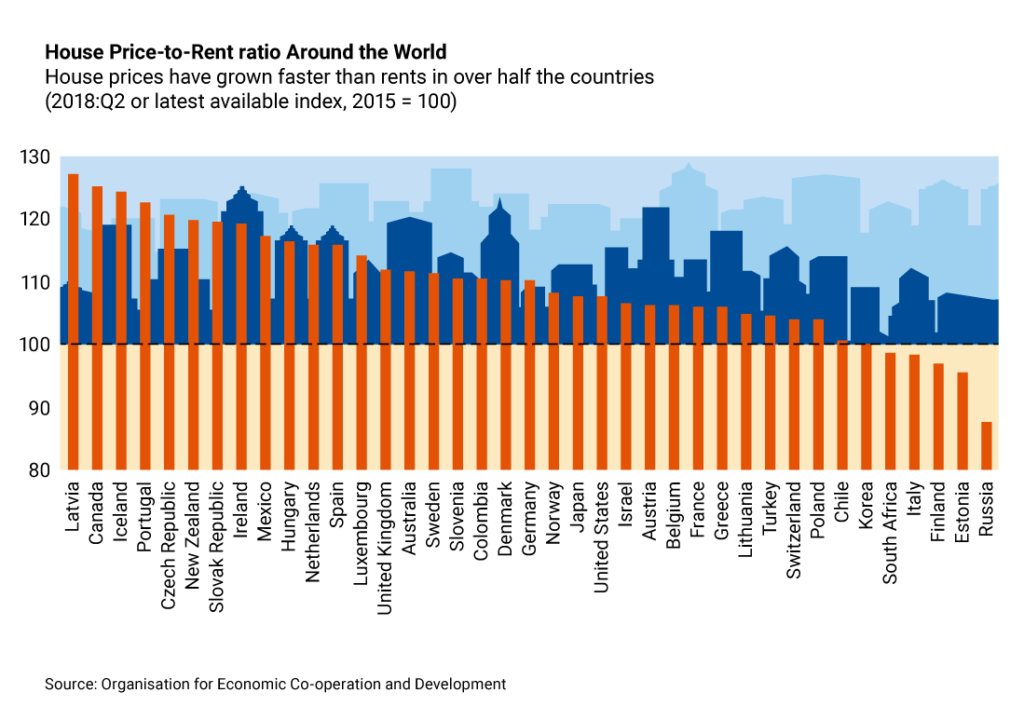

While developed markets such as US, Canada and UK have remained strong and attracted capital from investors worldwide, many of them are also considered to be approaching the peak of their cycles. As shown in the chart below, rental yields have fallen in most of the developed markets since 2015.

Alternative Real Estate Assets – Gaining Ground

For institutional investors, the pressure is to find attractive assets to place money in this competitive environment. Over the last decade, a few exciting alternative real estate sectors have emerged, offering steady and predictable cash flows to investors. Returns in some of these sectors offer the added advantage of being counter-cyclical and less correlated to core real estate returns. For large investors, these characteristics mean that, from a portfolio construction perspective, adding them offers real diversification benefits.

Listed below are six of the hottest alternative real estate asset classes, which are gaining attention from institutional investors worldwide.

1. Co-working Offices

Co-working offices offer a more flexible solution to freelancers, entrepreneurs and organizations, compared to traditional office spaces. The co-working office owner or operator provides a full suite of services, including concierge level support, conference rooms, health club facilities, food & beverages, internet and copier/printer facilities. They also offer flexible lease terms in terms of tenure and capacity, which may be beneficial for tenants that are scaling or where only a small number of employees require a desk space at any given time.

As reported by Colliers, a global real estate consultancy, in April 2019, there are over 15,000 co-working locations worldwide. Dubai has 53 co-working offices, amounting to 650,000 square feet of space, an increase of 130 percent since 2015. Still, co-working units constitute less than 1 per cent of the total office inventory in Dubai. JLL, another real estate consultancy, forecast in November 2018 that this could grow to about 5 per cent by 2022. This is still a young sector in Dubai in comparison to commercial centres like Tokyo, where there are over 110 such locations, and London which has more than 210.

2. Student Housing

JLL estimates that students in higher education will increase from 165 million in 2011 to 263 million by 2025. The bulk of these enrolments comes from China and India, where an increasing number of parents prefer to send their children to prestigious overseas institutions.

The fact that typical student housing schemes in tier 1 universities accommodate as many as 50 nationalities offers good diversification to investors. Rental income originating from a wider spread of countries reduces the risk of downturn if the domestic markets are not doing well. In fact, the sector can prove counter-cyclical during economic downturns, with higher education enjoying greater appeal during periods of lower employment.

However, the sector is so far largely concentrated in the UK, USA and Australia, where global investors such as GIC (Singapore) have invested in specialist operating platforms. UAE has the largest number of foreign university branches in the world. Dubai Academic City is an education hub where about 24,000 students are enrolled in various local and foreign universities. New student accommodations are being built to accommodate those students.

3. Data Centres

The amount of data flowing through our daily lives is booming. Every second, Google processes more than 40,000 searches. Every minute, there are 16 million texts sent around the world. Every day, more than 300 million photos are uploaded to Facebook. 2.5 quintillion bytes of data are created each day.

The number of people using the internet has grown from 1 billion people in 2005 to 3.9 billion in 2018, according to Statistica, an online market research firm. As per some estimates, more than 90 percent of the data in the world was created in the last two years. Data usage is accelerating faster than places to store the data.

The global revenue for the data centre market is growing at a 16 percent compound annual growth rate and is expected to reach USD 60 billion by 2020, according to Structured Research.

Long-term secular and structural trends related to internet consumption globally are underpinning growth prospects in the data centre market. Key drivers include urbanization, expanding consumer markets, and technological developments, including the rise of smart phones, cloud computing, and the internet of things (IoT). These developments indicate that the amount of data that businesses and individuals are creating and consuming will continue to explode.

Data centres present a compelling investment case. The above-mentioned demand drivers for data mean the sector is less impacted by the traditional real estate cycle. The business itself benefits from a high degree of stability as well. Data centre equipment has to be deployed and tested, so once it is commissioned it cannot be conveniently shut down and ported to a different location. That makes it harder for users to leave once they have deployed. Long-term operating leases of data centres ensure a stable income stream for investors. However, construction costs are significantly higher than for a traditional warehouse or office building.

These characteristics make data centres real estate appealing to traditional infrastructure investors, which are more risk averse, have longer investment horizons, and larger investment ticket sizes. In January 2019, AT&T sold its data centre colocation operations and assets to Brookfield Infrastructure and its institutional partners for USD 1.1 billion. Digital Realty Trust, a San Francisco-based data centre REIT, acquired Ascenty, a leading Latin American data centre provider, for USD 1.8 billion in Q4 2018, in partnership with Brookfield Infrastructure.

4. Senior Care Homes

Emerging global demographic trends make a strong case for investing in senior care facilities. As reported by Colliers in May 2018, advancements in healthcare, along with rising wealth levels, have increased life expectancy in Asia. The result is that the region’s senior (aged 65 and above) population will nearly triple by 2050 to 945 million. The number of people aged 75 and above (needing some sort of assistance in their daily lives) will jump from 137 million to 437 million over the same period.

In developed markets such as the US, the baby boomers (demographic category of people presently aged 55 to 73) already form the largest population category. While these baby boomers are still largely active and too young for senior care (average age of senior care residents is estimated at 83 years), they will increasingly be in need of such facilities in the decades to come.

Senior care facilities are an attractive investment and potentially offer higher and more stable returns than many other real estate asset classes. Senior care homes entail long-term rental terms. This offers an attractive proposition for long-term, income-focused investors. This is in contrast to the office sector, where tenants, driven by developments such as co-working, are increasingly demanding more flexible rental terms with shorter leases. Additionally, investment in senior housing provides diversification because the sector is not as cyclical as other real estate classes, as the demand is driven by broader demographic trends instead of economic activity.

As per a recent PwC report on emerging real estate trends, private equity returns for senior housing have outpaced those of other commercial real estate for the last ten years, on both appreciation and income generation. According to Q1 2018 NCREIF Property Index results, the annual return for senior housing in the US on a ten-year basis was 10.5 percent. This category outpaced the overall property index and apartment, both generating returns of 6.1 percent.

5. Self-Storage

About a third of self-storage customers are commercial, with start-ups, small businesses and online retailers using the space as a flexible solution for stock overflow as well as product distribution.

In the highly dense cities of Asia, where homes are getting smaller, self-storage facilities are becoming more and more popular. Vastly urbanised cities such as Hong Kong, Singapore and Tokyo have an average home size of less than 800 square feet, and people are turning to self-storage as overspill for their possessions.

Demand for self-storage, similar to conventional real estate classes, is driven by economic and demographic forces. Urbanisation is an important driver for the sector as larger urban populations mean smaller living spaces in cities and more renters, who move house more frequently than homeowners.

To generate better yields by providing differentiated service, investors will be drawn to niche categories in the self-storage sector. These include document storage, climate-controlled environments (such as wine storage), specialised spaces (such as for sports equipment storage), as well as space related to e-commerce pickup and delivery.

6. Cold Storage

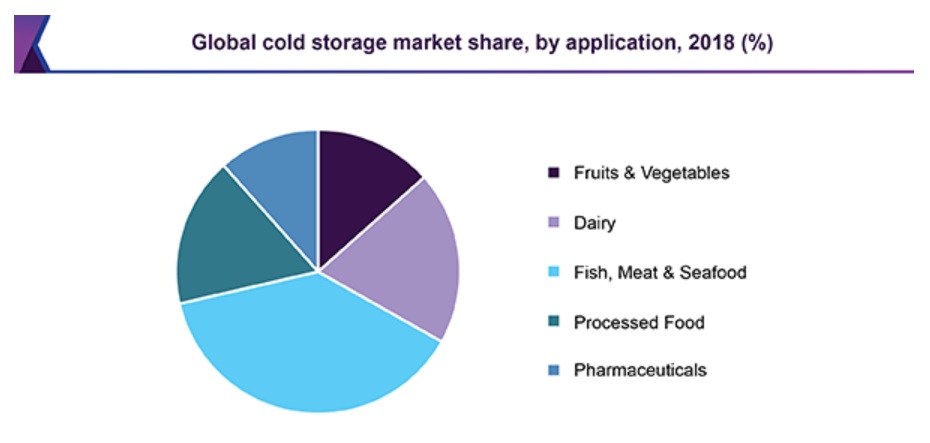

As per a recent report from JLL, available cold storage space is on the decline, as a number of factors, such as the rise of E-commerce and grocery delivery services, have increased demand in the sector. Growing global trade of perishable goods such as meat and dairy, driven by the burgeoning middle class segments in emerging market, has pushed demand for temperature-controlled storage.

In July 2018, US Department of Agriculture (USDA) reported that 2.5 billion pounds of chicken, turkey, beef and pork was stockpiled in cold storage in the US, the largest on record. This was partially a result of fresh tariffs introduced by China and Mexico on meat imports from US, lowering the demand for these imports.

Source: Grandviewresearch.com

The market for perishable foods is relatively recession-proof. Additionally, demand of cold storage for pharmaceuticals has also increased, driven by senior population growth in need of refrigerated medicines such as insulin.

Due to these factors, investor interest in cold storage facilities has increased tremendously. In July 2018, Lineage Logistics, North America’s second largest cold storage operator, announced a USD 700 million sale of minority ownership to two private equity firms. Americold Realty Trust, the world’s largest REIT specializing in cold storage, raised USD 834 million in an IPO in January 2018. This was followed by a follow-on offering of USD 1.3 billion in April 2019. Americold also announced acquisition of Cloverleaf Cold Storage, another large cold storage operator, in April 2019 for USD 1.24 billion. Blackstone, a private equity firm, previously owned a large stake in Cloverleaf, which it acquired back in November 2017.

Going Forward

The challenge for institutional investors is that the large amounts of capital they need to place means they need sectors where they can achieve scale and where they do not have to aggregate a large number of assets. Larger investors will also be very concerned about an exit strategy, so eventual market liquidity will be a major consideration. Currently, there is very little transactional activity in alternative real estate markets beyond North America and Europe.

While they still comprise less than 10 percent of the overall real estate market, there has been a strong trend of increasing demand for alternative real estate assets. This trend is not a fad, and is driven by shifting demographic trends (student housing, senior care facilities), changes in consumer demands (self-storage, cold storage) as well as the evolving corporate landscape (data centres, co-working offices). These developments re-affirm the expectation that these alternative real estate sectors are expected to grow over the coming years.