Uber for X or AirBnB for Y?

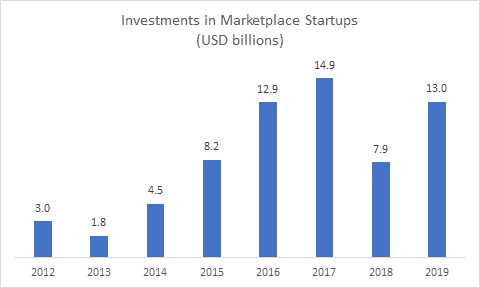

According to Crunchbase, USD 13 billion were raised globally by online marketplaces in 2019. This included USD 1 billion raised in a Series E round by by Rappi, a Columbia-based on-demand delivery start-up, in April 2019.

Source: Crunchbase

Source: Crunchbase

Prior to the mega successes of Uber and AirBnB, many investors failed to see the potential of online marketplaces. AirBnB’s founder Brian Chesky wrote in a medium post that he was rejected seven times by investors in 2008, when trying to raise USD 100K at a valuation of USD 1.5 million (it was last valued at USD 35 billion). In the last decade, however, these platforms have completely transformed multiple industries. They have gone beyond gaining market share from conventional incumbents and changed the way customers think about finding a place for their next holiday, hailing a taxi, or ordering food from their favourite neighbourhood restaurant. While the marketplace business model was not new (EBay and Amazon have been around since the 90’s), this rapid adoption can be heavily credited to the ubiquity of internet and smartphones seen during the last decade.

This has inspired many entrepreneurs to attempt to replicate their successes in various sectors and geographies. Venture capital investors, many of whom missed the boat when these giants were still in their infancy, have shown willingness to pour millions to discover the next uber success (as seen in the above chart).

Not all marketplace start-ups have been successful. Marketplaces need large enough buyer-seller network to achieve sustainability. In many cases, start-ups end up consolidating or die before they can get enough transaction volumes to sustain cashflows.

A careful study is required by founders looking to build a new marketplace, and VC’s planning to invest in one. To evaluate if a marketplace has potential, the following three areas need to be examined:

- How the buyers and sellers currently transact;

- How the marketplace will improve upon incumbents; and

- How the business will make money.

A useful starting point for investors and entrepreneurs for a detailed assessment of the above areas is to ask themselves the following 20 key questions about the marketplace.

- What is the product or service to be sold?

The first wave of marketplaces was horizontal in scope, selling a wide range of products and services to their customers. The most popular of these include Amazon, Ebay and Alibaba, which sell virtually everything on one platform. As newer start-ups have found it difficult to compete with the resources of these behemoths, some have found success by focusing on vertical markets. A vertical marketplace sells one or few categories of products and services and aims to provide a differentiated experience to its customers.

Etsy, a marketplace for arts and crafts products, started in 2005 and currently has a market cap of USD 5.8 billion. Although Amazon and Ebay sell plenty of such products, Etsy managed to make a name for itself by providing a superior experience to customers looking for creative ideas. Etsy also takes lower fees from sellers of these products compared to Amazon, thus incentivizing them to join the platform.

- Is the marketplace B2B, B2C or C2C?

Strategies for scaling and monetizing a marketplace vary widely, depending on whether the buyers and sellers are individuals or corporates. There are also instances where marketplaces evolve into hybrid models, serving both businesses and individuals.

AirBnB started primarily as a C2C (or P2P) marketplace, allowing individual homeowners to rent out their spare rooms to travellers looking for cheaper alternatives and a more authentic experience compared to staying in hotel rooms. However, the marketplace evolved to serve corporate buyers and sellers. Large operators of furnished apartments such as US-based Blueground started consolidating supply and manage the rentals and maintenance of homes on behalf of homeowners. AirBnB now also serves corporate clients that are looking for short term rentals for their employees at lower costs compared to hotels or in cities with a lack of available hotel rooms.

Success of AirBnb prompted B2C marketplaces such as Booking.com and Hotels.com to start listing vacation rentals from individual homeowners along with traditional hotel offerings.

- Who is the target buyer?

It is important to study various market segments and identify the target buyer segment when building or evaluating a marketplace. This focus helps build a customized experience for buyers with specific needs.

Mumzworld, a UAE-based online retailer for maternal and baby products, gained popularity by creating a unique shopping experience for expecting and new mothers. According to Crunchbase, Mumzworld raised USD 20 million in its last fundraising round in October 2018. Sprii, another UAE-based start-up targeting the same segment, raised USD 8.5 million in its latest round in June 2019.

However, a marketplace tailored for a buyer segment that is too small will be hard to scale.

- Who is the target seller?

A successful marketplace needs to scale supply as well as demand. Buyers will not visit a marketplace very often if there is limited selection of items to purchase on the platform. Marketplaces such as Uber and AirBnB started with the goal of helping owners looking to monetize their illiquid assets, such as their personal vehicle or free bed space. Start-ups in food and grocery delivery sectors such as Germany-based Delivery Hero and UK-based Deliveroo serve as three-way marketplaces. There are two distinct types of sellers on such platforms, the restaurants selling their products and riders providing the delivery service. They need an abundance of both kind of sellers for the platform to be appealing to the customer.

- Are the sellers fragmented or concentrated?

It is easier to start a marketplace when the market is fragmented, i.e., the sellers are small and numerous. Such sellers will be more open to pay a commission to the marketplace for getting access to a wider pool of buyers. India-based UrbanClap, a marketplace for professional services provides such as beauticians, plumbers, painters and repairmen, earn income through commissions and lead generation. The service providers in return get access to a much larger customer base than they would have on their own. UrbanClap, which recently re-branded itself to the Urban Company, raised USD 75 million in August 2019 at a valuation of USD 935 million.

- How does the buyer currently find the seller?

A marketplace can add more value to an industry (and hence position itself as vital) if the incumbent channels for buyers to find sellers are highly inefficient or costly. Prior to ride-hailing apps, customers had to hail taxis on the sidewalk or call the local radio taxi operator on the phone. In many countries, the customers then had to negotiate the fare with taxi drivers before starting their journey. Similarly, prior to apps like UrbanClap and Thumbtack (US), customers seeking plumbing or cleaning services had to traditionally rely on personal contacts or visit the nearby markets to find service providers.

- How will the marketplace add value to the buyers?

Buyers are more likely to use a marketplace if it creates a lot of value for them. This value can be in terms of ease of use, access to many sellers or larger product variety, or saving time and money. Ride-hailing platforms such as Uber, Ola (India) and Careem (MENA) became indispensable within a few years, by transforming the way customers would find and pay for a taxi. Customers could now simply order a taxi with a few clicks and track the driver’s progress on their smartphone. In most countries, customers can simply walk out of the taxi at the end of their journey, without having to take out cash or credit cards.

- How will the marketplace add value to the sellers?

For suppliers to list themselves on a marketplace and pay for lead generation, ads or commissions, they need to get value in return. Marketplaces add value to a seller’s business by increasing transaction frequency, providing access to more customers, improving online presence or managing transactions. Some marketplaces also provide crucial ancillary services such as logistics, online wallets and lending.

Online food ordering and delivery apps such as Doordash (US), Talabat (GCC) and Zomato (India) charge commissions of 15% – 30% for orders placed on their platforms and delivered by riders contracted by them. Restaurants are willing to pay such a large portion of their revenue because these platforms manage the entire order lifecycle. Restaurants only need to focus on preparing the food, and let platforms take care of marketing, order placement, payments, delivery and customer support. This has enabled operators to open virtual or dark kitchens, which are essentially kitchens without a storefront. Costs of running a dark kitchen are much lower than a full-service restaurant as there is no need to pay for logistics, prime real estate rents, maintenance, and service or delivery staff.

- What is the expected transaction frequency?

A marketplace has more value if the buyers need to use it frequently to transact. InstaShop, a UAE-based online grocery retailer started in 2015, saw its monthly active users grow to 350K, as reported by Gulf News in October 2019. India-based online grocery retailer Grofers has about 1 million monthly active users with an annual revenue run rate of USD 700 million, as reported by Business Today in December 2019. Even though most online grocery retailers worldwide struggle to reach profitability, they receive plenty of funding from investors. Grofers has received USD 597 million in funding till date, according to Crunchbase. Customers need to buy groceries on a regular basis, so it is relatively easy for grocery sellers to increase its MAU base and generate recurring revenue.

- Is the level of product or service differentiation and switching costs high?

High frequency of purchasing a product or service does not necessarily translate into a high frequency of using a marketplace. Buyers are less likely to use a marketplace when costs of switching a product or service provider are high. In such cases, buyers will continue to engage with their trusted sellers. For example, a family may need to frequently obtain healthcare or childcare services, but may not be keen to seek newer or cheaper service providers. A marketplace catering to these sectors may therefore not be too valuable for buyers.

Additionally, marketplaces with little or no product differentiation are also less valuable to buyers, as there may be little need to seek variety or browse for new suppliers other than for cost savings. Online apparel retailers such as Namshi (UAE) and Myntra (India) gained popularity as they enabled buyers to browse a wide variety of clothes at the convenience of their home.

- Is the price of product or service negotiated?

For certain products and services, buyers and sellers negotiate prices (or participate in auctions) before transacting. This tends to be especially true in C2C (raw materials, machinery) or P2P (pre-owned products, home services) transactions. A marketplace for such products and services needs to build in communication features for parties to interact with each other. Otherwise, the marketplace may be useful only as a search and discovery platform. While this was the business model of the first wave of online platforms such as Yelp, Craigslist and Dubizzle (UAE), some of which are still around, the revenue generation potential is limited to advertising and lead generation only. Marketplaces such as AirBnB and OLX (Netherlands-based C2C marketplace) allow parties to communicate and negotiate on the platform before completing the transaction.

- What is a typical transaction size?

Larger transaction sizes can provide good revenue generation potential for marketplaces even with lower transaction frequency. A customer may not have need to frequently look for used cars or long-term rentals, but each successful transaction will generate a much larger commission than a food delivery order.

However, lower frequency of transactions reduces the level of engagement of users with the marketplace, which may impact its value. Also, customers may be hesitant to commit to large value transactions on an online platform, especially in its early stages. Therefore, it may be harder for a young marketplace to gain user traction and trust.

- Will transactions be conducted on the marketplace?

For a marketplace to earn commission, transactions need to be conducted on the marketplace. OLX, the international P2P marketplace for new and used goods, is used by the sellers primarily as a listing platform. Once a buyer discovers a useful product, she can communicate with the seller and negotiate the price. The transactions however are typically settled offline when parties meet each other to exchange the goods and payments. Zomato, before facilitating order placement and food delivery services, began as a listing platform for users to discover local restaurants.

In some cases, it is difficult or not possible to complete a monetary transaction on an online platform. For example, real estate transactions require substantial regulatory approvals, making them impossible to be executed on an online platform in most countries. Also, social marketplaces such as Tinder (US-based dating app) and Shaadi (India-based matchmaking site) do not have a monetary component between parties. Such platforms can still earn revenue by charging for advertising, premium listings and lead generation. However, the added value to parties is limited in such a business model. Also, such a model can put them in competition with Google and Facebook, which is exceedingly hard for young platforms without significant scale.

- Is the sector highly regulated?

Start-ups trying to disrupt established players in reg-heavy industries are likely to face the same regulatory burdens as the incumbents. Transferwise, the UK-based remittance services provider, started out as a P2P platform to match currency senders in one country with receivers in another. This model came out of the pain points faced by the Estonian founders of the company. One earned Euros but had payments to be made in London, while the other earned British pounds but had liabilities in Estonia for which he needed Euros. However, remittance is a highly regulated sector worldwide. Remittance start-ups looking to operate in the Middle East, for example, need to obtain (often expensive) licenses to provide money transfer services in each country of operation. In the USA, Transferwise got registered with FinCEN, a Federal agency, along with getting money transfer license for each state where it wants to operate.

There can be additional regulatory and political hurdles faced by on-demand marketplaces on the supply side. AirBnB has faced political and regulatory pressures in cities all over the world. Governments in cities such as Paris and New York see AirBnB as a threat to local communities. They fear rental prices going up and residential neighbourhoods being disrupted, as more owners may prefer attractive short-term rentals over long-term tenants.

- What is the monetization strategy?

A marketplace can earn revenue through advertising, listing fees, lead generation and commissions. Managed marketplaces such as Zomato and Talabat earn a bulk of their income by providing additional services including last mile delivery. Start-ups may be willing to forgo some of these revenue channels to scale faster and encourage sellers to join the platform. However, they may face resistance from sellers if their services become chargeable at a later stage the sellers do not see the value in paying for the platform. Therefore, a marketplace needs to have a clear monetization strategy for each stage of growth as it becomes more entrenched in the eco-system.

- Is the marketplace network local, national, or international?

A marketplace may facilitate transactions among buyers and sellers available locally, nationally or internationally. Some business models, such as ride-hailing and last-mile delivery of food and groceries, typically connect parties within a small geographic radius. Such marketplaces can benefit from limited economies when scaling in other regions. For example, an online grocery ordering app with a large network of customers and retailers in New Delhi will have to acquire buyers and sellers from scratch when launching in Mumbai. Such marketplaces may also struggle to achieve scale in cities with lower population densities.

Cross-border marketplaces may have potential for higher TAM’s (see question 19) but face other challenges. These include managing cross-border logistics, complying with regulations, delivering consistent user experience and maintaining customer support. Some of these may also need to deploy business development resources in each new market to acquire buyers and sellers. Such challenges are difficult to overcome for start-ups in early stages without enough resources.

- Who are the local competitors?

For a new entrant, it is difficult to acquire buyers and sellers in a market which has one or more large incumbents. Most new start-ups would shy away from getting into direct competition with large global players such as Amazon, Uber and AirBnB if they are already present in the local market.

The ride hailing industry operates as a fierce duopoly in most cities. It is unlikely for a start-up to enter the market and compete against Uber and its large domestic competitor, such as Ola (India), Careem (Middle East, acquired by Uber in 2019), Lyft (USA), Didi (China, bought Uber’s Chinese business in 2016) and Grab (South East Asia, bought Uber’s regional business in 2018).

- Who are the international competitors?

Entrepreneurs may find it tempting to move into a market with no established local incumbents, especially if the business model has achieved success in other markets. However, international players can quickly enter and overtake a local market by leveraging their brands and large capital resources to gain market share. Therefore, founders and investors must keep an eye on competitors that may not be present locally but have a large presence in other countries.

However, new marketplaces can still achieve success by narrowing their focus on a niche segment or providing users with a differentiated experience. Ola, the Indian ride-hailing unicorn, was able to stay ahead of Uber in its early years by allowing drivers to accept cash payments, which is how most transactions take place in India. Uber eventually had to follow Ola and start accepting cash as well, which quickly became a dominant mode of payment for its India business.

- What is the size of the addressable market?

Investors need to get a sense of the start-up’s addressable market size. The most commonly looked-at metric of market size is the total addressable market (TAM). For example, UAE central bank reported that outward remittances from UAE stood at USD 44 billion in 2018. If the average cost of remittance is 3%, the TAM for a remittance start-up focussing on the outbound UAE market will be USD 1.3 billion. Let’s say that the start-up has built a marketplace which allows users to see real-time rates from exchange houses and takes a 50% cut of the remittance cost charged by the exchange house. As per the UAE central bank report, about 70% of the total outward remittances took place through exchange houses. In this case, the serviceable available market (SAM) for the marketplace will be USD 455 million, (or 50% of 70% of the TAM).

However, it should be noted that a marketplace may be able to create new supply and demand, like Uber and AirBnB have done in their respective markets. Therefore, benchmarking against conventional TAM and SAM estimates may not always provide a full picture of the marketplace’s potential.

- Do the founders have unique insights for the sector as buyer, seller or intermediary?

Ben Horowitz, founder of the prominent VC firm Andreeson Horowitz, calls it the “earned secret”. A founding team which possesses unique insights into a market, by virtue of prior experience as participants, can bring tremendous value to the business. While this is certainly not mandatory, such experience can help them identify the hard problems in the market and address them while building the platform.

Founders of US-based Hipcamp, the rental marketplace for camping sites, were avid campers themselves. They decided to launch Hipcamp in 2013 to address the problems they faced themselves when it came to booking campsites, such as popular sites filling up fast and poor design of government websites that listed public sites. They designed the site so that users could search by region, activities around the campsites and amenities. Users could also get all information regarding activities and rules in one place, instead of gathering fragmented information from Yelp and government sites. Hipcamp has managed to create a niche for itself in the short-term rentals industry, dominated by large players such as AirBnB and Booking.com, by focusing on niche properties such as campsites in national parks, privately owned farmland and ranches.

Very informative article

Thanks for reading!

Very Insightful article and lays out a good checklist for an early stage marketplace startup.

Thanks Harshmeen!

Great article covering all aspects of marketplaces. Thoroughly researched and well written. Great for idea generation for both investors and entrepreneurs .

Thanks for reading Aditya!

Excellent article-

Thanks Gagan for reading!